|

16.06.2017 01:07:00

|

92nd Common Stock Monthly Dividend Increase Declared By Realty Income

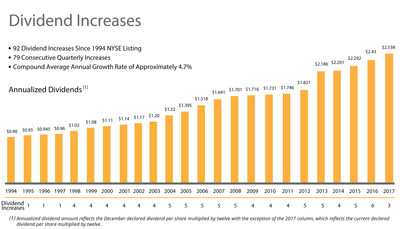

SAN DIEGO, June 15, 2017 /PRNewswire/ -- Realty Income Corporation (Realty Income, NYSE: O), The Monthly Dividend Company®, today announced its Board of Directors has declared an increase in the company's common stock monthly cash dividend to $0.2115 per share from $0.211 per share. The dividend is payable on July 14, 2017 to shareholders of record as of July 3, 2017. This is the 92nd dividend increase since Realty Income's listing on the NYSE in 1994. The ex-dividend date for July's dividend is June 29, 2017. The new monthly dividend represents an annualized dividend amount of $2.538 per share as compared to the current annualized dividend amount of $2.532 per share.

"We are pleased that our Board of Directors has once again determined that we are able to increase the amount of the monthly dividend we pay to our shareholders," said John P. Case, Chief Executive Officer of Realty Income. "With the payment of the July dividend, we will have made 564 consecutive monthly dividend payments and paid over $4.8 billion in dividends throughout our 48-year operating history."

About the Company

Realty Income, The Monthly Dividend Company®, is an S&P 500 company dedicated to providing shareholders with dependable monthly income. The company is structured as a REIT, and its monthly dividends are supported by the cash flow from over 4,900 real estate properties owned under long-term lease agreements with regional and national commercial tenants. To date, the company has declared 564 consecutive common stock monthly dividends throughout its 48-year operating history and increased the dividend 92 times since Realty Income's public listing in 1994 (NYSE: O). The company has in-house acquisition, portfolio management, asset management, credit research, real estate research, legal, finance and accounting, information technology, and capital markets capabilities. Additional information about the company can be obtained from the corporate website at www.realtyincome.com.

Forward-Looking Statements

Statements in this press release that are not strictly historical are "forward-looking" statements. Forward-looking statements involve known and unknown risks, which may cause the company's actual future results to differ materially from expected results. These risks include, among others, general economic conditions, local real estate conditions, tenant financial health, the availability of capital to finance planned growth, continued volatility and uncertainty in the credit markets and broader financial markets, property acquisitions and the timing of these acquisitions, charges for property impairments, and the outcome of legal proceedings to which the company is a party, as described in the company's filings with the Securities and Exchange Commission. Consequently, forward-looking statements should be regarded solely as reflections of the company's current operating plans and estimates. Actual operating results may differ materially from what is expressed or forecast in this press release. The company undertakes no obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date these statements were made.

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/92nd-common-stock-monthly-dividend-increase-declared-by-realty-income-300475091.html

SOURCE Realty Income Corporation

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Realty Income Corp.mehr Nachrichten

|

09.12.24 |

S&P 500-Papier Realty-Aktie: So viel Gewinn hätte ein Realty-Investment von vor einem Jahr abgeworfen (finanzen.at) | |

|

02.12.24 |

S&P 500-Wert Realty-Aktie: So viel Gewinn hätte ein Realty-Investment von vor 10 Jahren abgeworfen (finanzen.at) | |

|

25.11.24 |

S&P 500-Wert Realty-Aktie: So viel Verlust hätte eine Investition in Realty von vor 5 Jahren bedeutet (finanzen.at) | |

|

18.11.24 |

S&P 500-Wert Realty-Aktie: So viel Verlust hätte eine Investition in Realty von vor 3 Jahren bedeutet (finanzen.at) | |

|

11.11.24 |

S&P 500-Titel Realty-Aktie: So viel Gewinn hätte ein Investment in Realty von vor einem Jahr abgeworfen (finanzen.at) | |

|

04.11.24 |

S&P 500-Papier Realty-Aktie: So viel Gewinn hätte ein Realty-Investment von vor 10 Jahren eingefahren (finanzen.at) | |

|

03.11.24 |

Ausblick: Realty zieht Bilanz zum abgelaufenen Quartal (finanzen.net) | |

|

28.10.24 |

S&P 500-Wert Realty-Aktie: So viel Verlust hätte ein Investment in Realty von vor 5 Jahren eingebracht (finanzen.at) |