|

22.07.2021 13:30:00

|

Great Panther Announces High-Grade Intercepts from Tucano's Urucum North Deposit

TSX: GPR | NYSE American: GPL

Exploration drilling has delineated continuity in the underground zone and potential for expanding the open pit

VANCOUVER, BC, July 22, 2021 /CNW/ - Great Panther Mining Limited (TSX: GPR) (NYSE-A: GPL) ("Great Panther" or the "Company"), a growing gold and silver producer focused on the Americas, announces drill results for the Urucum North ("URN") deposit located at its wholly-owned Tucano mine in Brazil.

Rob Henderson, Great Panther's President & CEO commented: "We are very excited with the exploration results we are seeing from Tucano, which demonstrate the potential for additional near-term gold production. The high grades discovered at Urucum North are encouraging, and we are expediting studies to support a decision to initiate underground production to supplement the open pit feed to the mill. Drilling also identified shallow high-grade mineralization, which we believe will extend the Urucum North pit."

The URN underground project envisions an estimated 40,000 to 50,000 gold ounce ("Au oz") per year underground mine planned to extract ore from below the current URN open pit. In late 2020, Great Panther conducted additional drilling as part of a larger exploration program designed to update development studies to support a decision for the start-up of the underground project. The program is ongoing and significant drilling results to-date are presented below.

URN High-Grade Zone (Underground)

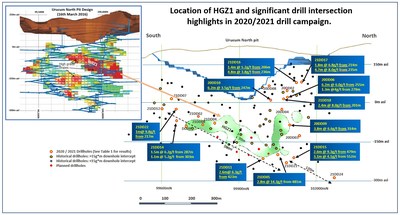

The URN High-Grade Zone 1 (HGZ1) lies less than 100 metres below the planned URN final pit shell. It is the shallowest high-grade zone defined in the mine plan. Nineteen holes were drilled within and along the up and down plunge extensions of HGZ1. Three of these are deep (i.e., +500 metres) drill holes completed to test the down plunge extension of this high-grade zone to demonstrate the down plunge continuity of the HGZ1 beyond the previous limits (see Figure 1). Key drill intersections from these holes include:

- 2.2 metres at 14.3g/t Au in 21URNDD005

- 2.6 metres at 6.3g/t Au in 21URNDD011

- 2.6 metres at 9.3g/t Au in 21URNDD015 and

- 3.1 metres at 4.1g/t Au also in 21URNDD015

Currently, the HGZ1 is approximately 500 metres long and remains open down plunge. Drill hole 21URNDD021 and 21URNDD024 are currently underway to test the extension.

URN Pit Extension to North

Twenty-six holes drilled between 2020 and 2021 (see Table 1) targeted shallow upper-level stopes defined in the URN underground project mine plan. These were identified for early production during ramp development. This additional drilling has delineated a near-surface zone of relatively high-grades with potential to incorporate the upper-level stopes into an extension of the URN open pit design.

Key highlights from drilling in this zone include:

- 2.4 metres @ 2.8g/t Au in 21URNDD020

- 2.4 metres @ 8.0g/t Au in 21URNDD018

- 1.8 metres @ 6.8g/t Au in 21URNDD017

- 4.7 metres @ 8.0g/t Au also in 21URNDD017

- 1.4 metres @ 5.2g/t Au in 21URNDD016

- 4.8 metres @ 3.8g/t Au also in 21URNDD016

- 6.2 metres @ 3.5g/t Au in 20URNDD010

- 1.3 metres @ 4.0g/t Au in 20URNDD006

- 2.8 metres @ 2.7g/t Au in 20URNDD012

- 1.1 metres @ 5.7g/t Au in 20URNDD002

The Company is conducting a mine planning trade-off evaluation between accessing this near-surface mineralization by extending the open pit or via underground stoping, as early ramp development in the current model will access this zone.

The Mine Trend

The drilling executed by Great Panther has improved our understanding of the high-grade zones at Tucano and the Company is applying this knowledge to the entire Tucano drilling database. Recent modelling of high-grade intersections along the 7-kilometre mine sequence indicates a repetition of high-grade zones with similar characteristics and similar controls, that have either been mined or are inferred from sparse drilling. This revised understanding will assist exploration efforts along the mine trend.

Full drill results are provided in the following table:

Hole Id | Target | Intercept | From | To | Est. Horiz. | Grade | Est. Horiz. |

(m) | (m) | (m) | Thickness (m) | (g/t Au) | gram*m | ||

21URNDD001 | Hole abandoned: re-drilled as 21URNDD002 | ||||||

21URNDD002 | HGZ1 up-plunge | 4.3 | 227.5 | 231.8 | 2.2 | 3.24 | 7.0 |

21URNDD003 | Hole abandoned: re-drilled as 21URNDD004 | ||||||

21URNDD004 | HGZ1 up-plunge | 2.9 | 274 | 276.9 | 1.7 | 3.67 | 6.1 |

21URNDD004 | HGZ1 up-plunge | 3 | 342 | 345 | 1.7 | 3.29 | 5.7 |

21URNDD005 | HGZ1 down- | 4.9 | 424 | 428.9 | 2.2 | 2.6 | 5.8 |

21URNDD005 | HGZ1 down- | 6.2 | 480.8 | 487 | 2.8 | 14.26 | 40.1 |

21URNDD011 | HGZ1 down- | 6.2 | 423 | 429.2 | 2.6 | 6.26 | 16.4 |

21URNDD012 | HGZ1 up-plunge | 6.5 | 173.3 | 179.8 | 2.4 | 2.09 | 5.1 |

21URNDD013 | Hole abandoned: to be re-drilled | ||||||

21URNDD014 | HGZ1 up-plunge | 2.75 | 286.8 | 289.5 | 1.5 | 6.19 | 9.0 |

21URNDD014 | HGZ1 up-plunge | 2 | 303 | 305 | 1.1 | 5.21 | 5.5 |

21URNDD015 | HGZ1 down- | 6.05 | 479.6 | 485.6 | 2.6 | 9.34 | 23.9 |

21URNDD015 | HGZ1 down- | 7.4 | 549.6 | 557 | 3.1 | 4.14 | 12.9 |

21URNDD016 | URN Extension | 2.35 | 206.3 | 208.7 | 1.4 | 5.21 | 7.4 |

21URNDD016 | URN Extension | 8 | 235.6 | 243.6 | 4.8 | 3.77 | 18.2 |

21URNDD017 | URN Extension | 3 | 214 | 217 | 1.8 | 6.83 | 12.6 |

21URNDD017 | URN Extension | 7.6 | 235 | 242.6 | 4.7 | 8.03 | 37.6 |

21URNDD018 | URN Extension | 4.8 | 201.2 | 206 | 2.4 | 8.02 | 19.2 |

21URNDD019 | Hole abandoned: to be re-drilled | ||||||

21URNDD020 | URN Extension | 4 | 220 | 224 | 2.4 | 2.82 | 6.8 |

21URNDD021 | HGZ1 down-plunge | Hole currently in progress | |||||

21URNDD022 | HGZ1 up-plunge | 2 | 217 | 219 | 1.03007615 | 9.84 | 10.1 |

21URNDD023 | Hole abandoned: wedge of 21URNDD21 | ||||||

21URNDD024 | HGZ1 down- | Hole currently in progress | |||||

20URNDD002 | URN Extension | 1.9 | 217 | 218.9 | 1.1 | 5.74 | 6.6 |

20URNDD002 | URN Extension | 4 | 241 | 245 | 2.4 | 2.13 | 5.1 |

20URNDD003 | URN Extension | 6.45 | 354 | 360.5 | 2.7 | 3.55 | 9.7 |

20URNDD004 | URN Extension | 3 | 282.6 | 285.6 | 1.5 | 3.03 | 4.5 |

20URNDD006 | URN Extension | 9.7 | 255.4 | 265.1 | 6.2 | 5.99 | 37.3 |

20URNDD006 | URN Extension | 2 | 279 | 281 | 1.3 | 4.01 | 5.2 |

20URNDD008 | URN Extension | 3.1 | 234.1 | 237.2 | 2.0 | 2.61 | 5.2 |

20URNDD009 | URN Extension | 8.4 | 313.7 | 322.1 | 3.8 | 6.56 | 25.0 |

20URNDD009 | URN Extension | 2 | 376 | 378 | 0.9 | 3.55 | 3.2 |

20URNDD010 | URN Extension | 11 | 247 | 258 | 6.2 | 3.52 | 21.7 |

20URNDD011 | URN Extension | 4.8 | 229.6 | 234.4 | 2.8 | 2.02 | 5.6 |

20URNDD011 | URN Extension | 3.6 | 247.2 | 250.8 | 2.1 | 1.95 | 4.0 |

20URNDD012 | URN Extension | 4.95 | 227.6 | 232.5 | 2.8 | 2.71 | 7.7 |

20URNRC001 | URN Extension | 3 | 80 | 83 | 1.9 | 2.67 | 5.1 |

20URNRC001 | URN Extension | 6 | 83 | 89 | 3.9 | 2.38 | 9.2 |

20URNRC001 | URN Extension | 7 | 108 | 115 | 4.5 | 3.48 | 15.7 |

20URNRC001 | URN Extension | 1 | 118 | 119 | 0.6 | 14.48 | 9.3 |

* Significant results: +3.2 gram*meters (Est. horizontal thickness used). | |||||||

Minimum cut-off: 1.6 g/t Au | |||||||

Max internal dilution: 2 m | |||||||

Estimated horizontal thickness calculated assuming vertical mineralization and inclination of drill hole. | |||||||

Technical Disclosure and Qualified Persons

On behalf of Great Panther, Nicholas Winer, Fellow AusIMM and Vice President of Exploration, supervised the preparation of data for the drillholes included in this news release and Nicholas Winer, together with Fernando A. Cornejo, P. Eng. and Chief Operating Officer, approved this news release. Mr. Winer and Mr. Cornejo are non-independent Qualified Persons as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

The Qualified Person reviewed the Tucano QA/QC program. The QA/QC program for drill core includes the regular insertion of blanks, standards, and duplicates into sample batches, diligent monitoring of assay results, and necessary remedial actions. Resource drilling samples are first assayed at the Tucano onsite laboratory. All intervals with anomalous gold are submitted and re-analyzed by the Certified SGS Geosol laboratory in Belo Horizonte by 50 g fire-assay. All SGS Geosol assays, after diligent monitoring of QA/QC and necessary remedial actions, supersede the Tucano assay results in the database for Mineral Resource and Mineral Reserve grade estimation. QA/QC monitoring of the SGS laboratory also includes inter-laboratory checks on five percent of samples with the Certified ALS laboratory in Belo Horizonte. In addition to the data verification methodology described above, personal inspections of the Tucano property have also been completed.

For more information about the Company's underground URN project, including its mine plan, see the Company's Annual Information Form for the year ended December 31, 2020 and the technical report dated February 2, 2021 entitled "Amended and Restated Technical Report on the 2020 Mineral Reserves and Mineral Resources of the Tucano Gold Mine, Amapa State, Brazil" filed with the Canadian Securities Administrators available at www.sedar.com and with the Securities and Exchange Commission available at www.sec.gov.

ABOUT GREAT PANTHER

Great Panther is a growing gold and silver producer focused on the Americas. The Company owns a diversified portfolio of assets in Brazil, Mexico and Peru that includes three operating gold and silver mines, four exploration projects, and an advanced development project. Great Panther is actively exploring large land packages in highly prospective districts and is pursuing acquisition opportunities to complement its existing portfolio. Great Panther trades on the Toronto Stock Exchange trading under the symbol GPR, and on the NYSE American under the symbol GPL.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of Canadian securities laws (together, "forward-looking statements"). Such forward-looking statements may include, but are not limited to, statements regarding: (i) potential for additional near-term gold production resulting from exploration activities at in the URN pit; (ii) potential for a decision to initiate underground production to supplement the open pit feed to the mill and expectations around the timeline for the studies in support of such decision, (iii) potential for high-grade mineralization at the URN open pit to allow extension of the mineable area of the pit and the related expectations of continuity of the underground zone; (iv) the estimated potential of 40,000 to 50,000 gold ounce ("Au oz") per year from the underground mine below the current URN open pit; and (v) whether Great Panther's exploration program will support a decision for the start-up of the underground project.

These forward-looking statements reflect the Company's current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: continued operations at Tucano in accordance with the Company's mine plan, including the expectations regarding the likelihood of exploration results in the URN high-grade zone to justify a positive start-up decision for the URN underground mine project and/or extension of the URN open pit; the ability of the Company to successfully start-up and execute the URN underground mining project; the ongoing geotechnical control/stability of UCS and the Company's ability to successful access the mineralization in the UCS pit without additional costs or interruption; continuation of operations without interruption, additional costs, workforce and supply shortages due to COVID-19 or any other reason; the accuracy of the Company's Mineral Reserve and Mineral Resource estimates and the assumptions upon which they are based; ore grades and recoveries; prices for silver, gold, and base metals remaining as estimated; national and international transportation arrangements to deliver Tucano's gold doré to international refineries continue to remain available, despite inherent risks due to COVID–19; international refineries that the Company uses continue to operate and refine the Company's gold doré, and in a timely manner such that the Company is able to realize revenue from the sale of its refined metal in the timeframe anticipated, despite inherent risks due to COVID–19; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation) remaining as estimated; currency exchange rates remaining as estimated; all necessary permits, licenses and regulatory approvals for the Company's operations are received in a timely manner and maintained, operations not being disrupted by issues such as pit-wall failures or instability, mechanical failures, labour disturbances or workforce shortages, illegal occupations or mining, seismic events, and adverse weather condition; assumption that the Company will be successful in resolving the legal claims that ban the use of cyanide in the Tucano processing; conditions in the financial markets; the ability to procure equipment and operating supplies and that there are no material unanticipated variations in the cost or availability of energy or supplies; and the Company's ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements expressed or implied by such forward-looking statements to be materially different. Such factors include, among others, risks and uncertainties relating to potential political, regulatory, and social risks involving Great Panther's operations in a foreign jurisdiction; developments with respect to COVID-19 that may impact the Company's operations, including potential for further workforce and supply shortages, or future orders of federal governments to curtail or cease mining operations or voluntary shutdowns; the inherent risk that estimates of Mineral Reserves and Resources may not be accurate or that the assumptions upon which they are based are different than expected and accordingly that mine production will not be as estimated or predicted; the discontinuity of the Tucano ore body and mine selectivity may result in a risk that dilution and mining recovery estimates used in the Mineral Reserve estimation do not accurately reconcile with the Company's ability to recover the tonnage, grade and metal content estimated in the Mineral Reserves; as the Company's mines, including, but not limited to its Mexican operations, do not have established Mineral Reserves, except for Tucano and the Company may extend mine operations by mining material at Tucano that is classified as a Mineral Resource without completing a feasibility study demonstrating economic or technical viability, the Company faces higher risks that anticipated rates of production/recovery or estimates of costs will not be achieved; litigation risk, including a risk that the use of cyanide would be banned in respect of Tucano's operations causing Tucano to have to cease operations if an alternative to cyanide treatment cannot be identified and implemented in a cost-effective way (of which there is no assurance); the potential for unexpected costs and expenses; fluctuations in metal prices; fluctuations in currency exchange rates; physical risks inherent in mining operations (including pit wall collapses, tailings storage facility failures, environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather); potential of further instability or failure of walls of the UCS pit, which compromises a material part of the Mineral Reserves being accessed in 2021, there is no assurance that the Company will be able to continue mining and be able to access the UCS Mineral Reserves which may adversely impact the Company's Mineral Reserve estimates, production guidance and future revenues, including the potential risk that the Mineral Reserves at UCS may not be accessible at all or that access may be dependent on further remedial work that might interrupt operations; there is no assurance that the Company will be able to identify or complete acquisition opportunities and other risks and uncertainties, including those described in respect of Great Panther, in its annual information form for the year ended December 31, 2020 and material change reports filed with the Canadian Securities Administrators available at www.sedar.com and reports on Form 40-F and Form 6-K filed with the Securities and Exchange Commission and available at www.sec.gov. There is no assurance that such forward-looking statements will prove accurate; results may vary materially from such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements. The Company has no intention to update forward-looking statements except as required by law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/great-panther-announces-high-grade-intercepts-from-tucanos-urucum-north-deposit-301339140.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/great-panther-announces-high-grade-intercepts-from-tucanos-urucum-north-deposit-301339140.html

SOURCE Great Panther Mining Limited

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Great Panther Silver Ltdmehr Nachrichten

| Keine Nachrichten verfügbar. |