|

22.07.2020 23:15:00

|

Core Lab Reports Second Quarter 2020 Results From Continuing Operations:

AMSTERDAM, July 22, 2020 /PRNewswire/ -- Core Laboratories N.V. (NYSE: "CLB US" and Euronext Amsterdam: "CLB NA") ("Core", "Core Lab", or the "Company") reported that continuing operations resulted in second quarter 2020 revenue of $115,700,000. The financial results for the second quarter of 2020 include a charge of $13,300,000 associated with: 1) severance in connection with on-going cost reduction initiatives, 2) a non-cash inventory write-down, and 3) other non-cash charges. Core's operating loss was $2,600,000, with a loss per diluted share of $0.13, all in accordance with U.S. generally accepted accounting principles ("GAAP"). Operating income, ex-items, a non-GAAP financial measure, was $10,700,000, yielding operating margins of 9.2% and earnings per diluted share ("EPS"), ex-items, of $0.14. A full reconciliation of non-GAAP financial measures is included in the attached financial tables.

Core's Board of Supervisory Directors ("Board") and the Company's Executive Management continue to focus on strategies that maximize return on invested capital ("ROIC") and free cash flow ("FCF"), a non-GAAP financial measure defined as cash from operations less capital expenditures, factors that have high correlation to total shareholder return. Core's asset-light business model and capital discipline promote capital efficiency and are designed to produce more predictable and superior long-term ROIC.

Cost Reduction Initiatives and Company Response to COVID-19 Pandemic

On 23 June 2020, the Company announced Phase 2 of cost reduction measures in response to market conditions and operational disruptions associated with COVID-19. Combined, the Phase 1 and Phase 2 cost reduction initiatives amount to reduced cash outflows of approximately $61,000,000, on an annualized basis, and in excess of $15,000,000 on a quarterly basis. Although substantially implemented throughout the second quarter of 2020, the now expanded cost reduction plan will be completed in the third quarter of 2020, further aligning Core Lab's operations with client activity levels. As previously announced, annual capital expenditures are expected to be reduced by approximately 50%, as compared to 2019. The Company will continue to monitor the outlook for the industry and evaluate Core's cost structure accordingly.

The following table summarizes the projected impact to cash flow associated with the actions described above. Compared to 2019, the forecast for 2020 shows reduced cash outflows totaling $142,600,000.

(in $ millions) | 2019 | Forecast | Reduced | Annualized Outflows | ||||||||||||

Dividend Payout1 | $ | 97.7 | $ | 12.4 | $ | (85.3) | $ | (95.9) | ||||||||

Capital Expenditures1 | 22.3 | 11.0 | (11.3) | (11.3) | ||||||||||||

Cost Reduction Initiatives1 | — | (46.0) | (46.0) | (61.0) | ||||||||||||

Reduced Cash Outflows | $ | 120.0 | $ | (22.6) | $ | (142.6) | $ | (168.2) | ||||||||

(1) Reduced dividend policy and reduced 2020 capital expenditure plan announced 16 March 2020. Cost reduction initiatives - Phase 1, announced 22 April 2020, Phase 2, announced 23 June 2020. | ||||||||||||||||

The Company continues to operate as an essential business with timely delivery of products and services to its clients during the COVID-19 global pandemic. The risks and uncertainties associated with COVID-19 continue to potentially have a material impact to both the Company's and its clients' operations.

Liquidity, Free Cash Flow, Dividends and Share Repurchases

During the second quarter of 2020, Core continued to generate FCF, with cash from operations of $27,000,000 and capital expenditures of $3,100,000, yielding FCF of $23,900,000. The second quarter of 2020 marks the 75th consecutive quarter that the Company generated positive FCF, despite the challenging market and industry conditions. Free cash was almost entirely focused towards reducing the Company's debt, as net debt was reduced by $23,000,000 during the second quarter 2020, and by $29,000,000 during the first half of 2020. Core will continue applying its excess free cash flow towards debt reduction for the foreseeable future.

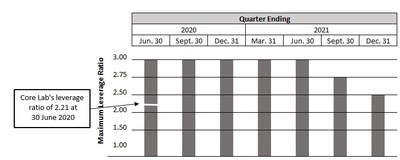

As previously announced on 23 June 2020, in response to the economic events associated with COVID-19 and the related downturn in oil and gas industry activity, Core Lab successfully negotiated an amendment to the Company's Credit Facility (the "Amendment"). The Amendment provides an increase to the maximum leverage ratio (calculated as total net debt divided by trailing twelve months adjusted EBITDA) permitted under the Credit Facility, among other things.

As of 30 June 2020, the Company has $73,000,000 of excess capacity under its $225,000,000 Credit Facility, and anticipates it will continue to generate positive cash flow and reduce net debt, while maintaining ample liquidity.

On 28 April 2020, the Board announced a quarterly cash dividend of $0.01 per share of common stock, which was paid on 19 May 2020 to shareholders of record on 8 May 2020. Dutch withholding tax was deducted from the dividend at a rate of 15%.

On 17 July 2020, the Board announced a quarterly cash dividend of $0.01 per share of common stock, payable on 10 August 2020 to shareholders of record on 27 July 2020. Dutch withholding tax will be deducted from the dividend at a rate of 15%.

Reservoir Description

Reservoir Description revenue in the second quarter of 2020 was $88,400,000, down 14% sequentially. Operating income for the second quarter of 2020 on a GAAP basis was $13,500,000, while operating income, ex-items, was $15,100,000, yielding operating margins, ex-items, of 17%, up 200 BPS sequentially. The decline in revenue on a sequential basis was attributable to continued industry disruptions associated with COVID-19. On-going efforts to align the Reservoir Description segment with client activity levels helped to mitigate the impact to operating margins.

Reservoir Description operations are heavily exposed to international and offshore activity, with approximately 80% of its revenue sourced from projects outside the U.S., where core, reservoir fluid and derived product samples originate from international project activity. For example, during the second quarter of 2020, Core's Middle East operations continued to receive new work on highly specialized core and reservoir fluid projects throughout the region. Core's network of laboratories in the Middle East include strategic locations in Kuwait, United Arab Emirates, Kingdom of Saudi Arabia and Qatar. Earlier this year Core completed the commissioning of a comprehensive reservoir fluids laboratory in Doha, Qatar, adding to its existing reservoir rock laboratory capabilities. This new fluids laboratory includes Core's proprietary, full visualization, high-pressure, high-temperature, pressure-volume-temperature ("PVT") cell instrumentation. These highly automated systems are uniquely designed to measure phase behavior of reservoir fluids with high concentrations of H2S and CO2 gases commonly found in the region. Core expects continued demand for its proprietary laboratory services in the Middle East as a result of several factors, including the resumption of production from the Wafra oilfield, located within the Partitioned Neutral Zone in southern Kuwait, as well as the expansion of the North gas field in Qatar. Core continues to evaluate additional opportunities for laboratory expansion in the region to meet client requests.

Also in the second quarter of 2020, industry adoption of Core's proprietary, web-enabled data management system, Reservoir Applied Petrophysical Integrated Data service ("RAPID™"), continued to increase, as the RAPID™ platform was adopted by a national oil company ("NOC") in the Middle East. RAPID™ provides this NOC with centralized, consistent, and easily accessible data in a secure format. RAPID™ enables the client to quickly and efficiently organize, archive, retrieve and analyze large quantities of geological, petrophysical, reservoir engineering, and reservoir fluids data, and will serve as the NOC's primary repository for this reservoir data. The RAPID™ platform also allows sophisticated database queries from a user-friendly interface. Coupled with Core Lab's Worldwide Rock Catalog, Core's Relative Permeability Toolkit, and other proprietary data tools, RAPID™ can be used to search for reservoir analogs, predict petrophysical and engineering parameters, and to integrate new laboratory data being acquired as part of on-going analytical programs. Core Lab continues its leadership role in the digitization of the oilfield, connecting data analytics tools, data lakes, and data mesh technologies. As the industry's pioneering database for subsurface reservoir data, RAPID™ has evolved and expanded over decades of commercial application, and has become the primary data platform for a suite of independent, national and international oil companies.

Production Enhancement

Production Enhancement operations, which are largely focused on complex completions in unconventional, tight-oil reservoirs in the U.S., as well as conventional offshore projects across the globe, posted second quarter 2020 revenue of $27,300,000, falling 45% sequentially. By comparison, the second quarter 2020 North American rig count and U.S. land completion activity fell over 60% on a sequential basis. Operating loss on a GAAP basis was $16,300,000, which includes non-cash charges of $11,600,000, associated with inventory write-downs, asset impairments and severance costs. Operating loss, ex-items, was $4,600,000. These results were partially mitigated by cost-control actions during the second quarter of 2020, limiting sequential quarterly decremental margins to 37%.

During the second quarter of 2020, Core's Plug-and-Abandonment ("PAC™") energetic technology continued to gain market acceptance in the North Sea and Gulf of Mexico ("GOM") regions. When a well reaches the end of its economic life, an operator will determine a plug-and-abandonment strategy. Core's PAC™ energetic system technology penetrates a single casing string, or as many as four casing strings, without penetrating the outer casing. This technique enables the operator to establish circulation in the annular space between casing strings, and set functional cement barriers prior to abandoning the well. Compared with conventional section milling, Core Lab's PAC™ perforating methodology enables significant cost savings by reducing the number of rig days, saving the operator $6,000,000 to $8,000,000 per abandoned well. PAC™ provides Core's clients with an effective and efficient solution when executing multimillion-dollar plug-and-abandonment programs and demonstrates Core's Production Enhancement ballistic engineers' ability to adapt downhole technological advances to diverse industry needs.

As a result of the client's success with the PAC™ energetic system technology, Core Lab has been enlisted by additional NOC's to design plug-and-abandonment energetic systems for use in high cost, offshore environments. The Core Lab Engineering Testing Solutions team is receiving upfront funding from its client to design systems specific to each such operator's well design and casing requirements.

During the second quarter of 2020, Core's SpectraStim™, SpectraScan®, and PackScan® downhole imaging technologies were utilized in a client's deepwater GOM well after a screen-out did not occur during the well completion. Prior to Core's client attempting a remediation program, Core's downhole imaging diagnostics were utilized to determine if an effective formation frac and annular pack, with ample proppant reserve above the top of the downhole sand control screen, had been achieved. Sufficient proppant placement in the annulus is required to restrict the migration of formation fines during production, and to keep mobile sand particles from cutting screens, damaging surface facilities, and filling the wellbore. To reduce operator rig time, Core's engineering team processed the diagnostic analysis within two hours of receiving downhole images from the rig site.

Core's conclusion from the diagnostic analysis was that the well did not require a top-off treatment. After discussions between the Production Enhancement engineering team and client, it was unanimously agreed that an effective frac and competent annular pack with ample proppant reserve had been obtained. Thus, a remedial top-off treatment costing more than $1,000,000 was not required, nor would it have been operationally successful if attempted. The client acknowledged the quality of Core's diagnostic analysis and the timeliness of execution.

Return On Invested Capital

The Company and its Board believe that ROIC is a leading long-term performance metric used by shareholders to determine the relative investment value of publicly traded companies. Further, the Company and its Board believe that shareholders will benefit if Core consistently performs at high levels of ROIC relative to its Comp Group. Core Lab's commitment to capital stewardship is driven in part by the Company's continuing philosophy of having a low capital-intensive business.

Events associated with the COVID-19 global pandemic have caused significant disruptions in global markets and economies, with adverse effects throughout the energy sector. These adverse effects have triggered significant asset impairments for goodwill, intangible assets, inventory and other fixed assets, which further distort underlying financial performance and performance metrics, such as ROIC.

The Company's Board has established an internal performance metric of demonstrating superior ROIC performance relative to the oilfield service companies listed as Core's Comp Group by Bloomberg. Core Lab recorded $122 million in non-cash charges associated with the impairment of goodwill and intangible assets. Excluding these non-cash asset impairments, Bloomberg's calculation of Core's ROIC was 8.5%, which continues to be higher than the Company's Weighted Average Cost of Capital ("WACC"). Under the current circumstances and considering the magnitude of the asset and goodwill impairment charges incurred across the energy industry, it is difficult to appropriately determine the underlying relative performance across the Bloomberg Comp Group as compared with Core Lab.

Industry and Core Lab Outlook

Although crude-oil prices improved from the lows seen in May, E&P companies further reduced their 2020 capital expenditure plans, especially in the U.S., as witnessed by a steep decline in the frac spread index and an over 60% decline in completion activity. As the third quarter of 2020 began, U.S. land activity improved slightly from the lows experienced during the middle of the second quarter. In addition, travel restrictions and supply chain disruptions associated with COVID-19 continue to delay international project activity.

Core continues to project international activity to be down approximately 10 – 15% year-over-year. The pace and breadth of recovery from COVID-19 restrictions remains highly uncertain, making it difficult to forecast the level and timing of client activity. Therefore, Core is unable to provide meaningful quantitative quarterly guidance. From a qualitative perspective, the Company expects project work and international shipment of products to improve somewhat during the second half of 2020 from the lows experienced mid-second quarter 2020.

For Reservoir Description, we expect reservoir fluids analysis, which accounts for more than 65% of this segment's revenue, to be more resilient given this work is not solely tied to drilling and completion of new wells.

Production Enhancement has a wide range of innovative product offerings with on-going projects unrelated to drilling and completion, including a large international plug and abandonment and well remediation program. Production Enhancement should track or outperform future improvements in U.S. land completions.

Earnings Call Scheduled

The Company has scheduled a conference call to discuss Core's second quarter 2020 earnings announcement. The call will begin at 7:30 a.m. CDT / 2:30 p.m. CEST on Thursday, 23 July 2020. To listen to the call, please go to Core's website at www.corelab.com.

Core Laboratories N.V. is a leading provider of proprietary and patented reservoir description and production enhancement services and products used to optimize petroleum reservoir performance. The Company has over 70 offices in more than 50 countries and is located in every major oil-producing province in the world. This release, as well as other statements we make, includes forward-looking statements regarding the future revenue, profitability, business strategies and developments of the Company made in reliance upon the safe harbor provisions of Federal securities law. The Company's outlook is subject to various important cautionary factors, including risks and uncertainties related to the oil and natural gas industry, business conditions, international markets, international political climates, public health crises, such as the COVID-19 pandemic, and any related actions taken by businesses and governments, and other factors as more fully described in the Company's most recent Forms 10-K, 10-Q and 8-K filed with or furnished to the U.S. Securities and Exchange Commission. These important factors could cause the Company's actual results to differ materially from those described in these forward-looking statements. Such statements are based on current expectations of the Company's performance and are subject to a variety of factors, some of which are not under the control of the Company. Because the information herein is based solely on data currently available, and because it is subject to change as a result of changes in conditions over which the Company has no control or influence, such forward-looking statements should not be viewed as assurance regarding the Company's future performance. The Company undertakes no obligation to publicly update or revise any forward-looking statement to reflect events or circumstances that may arise after the date of this press release, except as required by law.

Visit the Company's website at www.corelab.com. Connect with Core Lab on Facebook, LinkedIn and YouTube.

CORE LABORATORIES N.V. & SUBSIDIARIES | |||||||||||||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||||||||||||

(amounts in thousands, except per share data) | |||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||

Three Months Ended | % Variance | ||||||||||||||||||||

June 30, 2020 | March 31, | June 30, 2019 | vs. Q1-20 | vs. Q2-19 | |||||||||||||||||

REVENUE | $ | 115,736 | $ | 152,400 | $ | 169,038 | (24.1)% | (31.5)% | |||||||||||||

OPERATING EXPENSES: | |||||||||||||||||||||

Costs of services and sales | 90,680 | 115,131 | 124,451 | (21.2)% | (27.1)% | ||||||||||||||||

General and administrative expense | 9,221 | 19,567 | 9,801 | (52.9)% | (5.9)% | ||||||||||||||||

Depreciation and amortization | 5,425 | 5,441 | 5,786 | (0.3)% | (6.2)% | ||||||||||||||||

Inventory write-down and impairments | 9,932 | 122,204 | — | (91.9)% | NM | ||||||||||||||||

Other (income) expense, net | 3,045 | (970) | 992 | NM | 207.0% | ||||||||||||||||

Total operating expenses | 118,303 | 261,373 | 141,030 | (54.7)% | (16.1)% | ||||||||||||||||

OPERATING INCOME (LOSS) | (2,567) | (108,973) | 28,008 | NM | NM | ||||||||||||||||

Interest expense | 3,369 | 3,411 | 3,714 | (1.2)% | (9.3)% | ||||||||||||||||

Income (loss) from continuing operations before income tax expense | (5,936) | (112,384) | 24,294 | NM | NM | ||||||||||||||||

Income tax expense (benefit) | (261) | (4,046) | 4,808 | NM | NM | ||||||||||||||||

Income (loss) from continuing operations | (5,675) | (108,338) | 19,486 | NM | NM | ||||||||||||||||

Income (loss) from discontinued operations, net of income taxes | — | — | 7,971 | NM | NM | ||||||||||||||||

Net income (loss) | (5,675) | (108,338) | 27,457 | NM | NM | ||||||||||||||||

Net income (loss) attributable to non- controlling interest | 41 | 83 | 43 | (50.6)% | (4.7)% | ||||||||||||||||

Net income (loss) attributable to Core Laboratories N.V. | $ | (5,716) | $ | (108,421) | $ | 27,414 | NM | NM | |||||||||||||

Diluted EPS (loss per share) from continuing operations | $ | (0.13) | $ | (2.44) | $ | 0.43 | NM | NM | |||||||||||||

Diluted EPS (loss per share) attributable to Core Laboratories N.V. | $ | (0.13) | $ | (2.44) | $ | 0.61 | NM | NM | |||||||||||||

Weighted average diluted common shares outstanding | 44,470 | 44,447 | 44,815 | 0.1% | (0.8)% | ||||||||||||||||

Effective tax rate | (4) | % | (4) | % | 20 | % | NM | NM | |||||||||||||

SEGMENT INFORMATION: | |||||||||||||||||||||

Revenue: | |||||||||||||||||||||

Reservoir Description | $ | 88,442 | $ | 102,702 | $ | 105,649 | (13.9)% | (16.3)% | |||||||||||||

Production Enhancement | 27,294 | 49,698 | 63,389 | (45.1)% | (56.9)% | ||||||||||||||||

Total | $ | 115,736 | $ | 152,400 | $ | 169,038 | (24.1)% | (31.5)% | |||||||||||||

Operating income (loss): | |||||||||||||||||||||

Reservoir Description | $ | 13,534 | $ | 11,062 | $ | 15,878 | 22.3% | (14.8)% | |||||||||||||

Production Enhancement | (16,324) | (121,299) | 10,424 | NM | NM | ||||||||||||||||

Corporate and Other | 223 | 1,264 | 1,706 | NM | NM | ||||||||||||||||

Total | $ | (2,567) | $ | (108,973) | $ | 28,008 | NM | NM | |||||||||||||

"NM" means not meaningful | |||||||||||||||||||||

CORE LABORATORIES N.V. & SUBSIDIARIES | |||||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||||

(amounts in thousands, except per share data) | |||||||||||||

(Unaudited) | |||||||||||||

Six Months Ended | % Variance | ||||||||||||

June 30, 2020 | June 30, 2019 | ||||||||||||

REVENUE | $ | 268,136 | $ | 338,232 | (20.7)% | ||||||||

OPERATING EXPENSES: | |||||||||||||

Costs of services and sales | 205,811 | 251,834 | (18.3)% | ||||||||||

General and administrative expense | 28,788 | 27,238 | 5.7% | ||||||||||

Depreciation and amortization | 10,866 | 11,373 | (4.5)% | ||||||||||

Inventory write-down and impairments | 132,136 | — | NM | ||||||||||

Other (income) expense, net | 2,075 | 3,365 | (38.3)% | ||||||||||

Total operating expenses | 379,676 | 293,810 | 29.2% | ||||||||||

OPERATING INCOME (LOSS) | (111,540) | 44,422 | NM | ||||||||||

Interest expense | 6,780 | 7,440 | (8.9)% | ||||||||||

Income (loss) from continuing operations before income tax expense | (118,320) | 36,982 | NM | ||||||||||

Income tax expense (benefit) | (4,307) | (22,802) | NM | ||||||||||

Income (loss) from continuing operations | (114,013) | 59,784 | NM | ||||||||||

Income (loss) from discontinued operations, net of income taxes | — | 8,230 | NM | ||||||||||

Net income (loss) | (114,013) | 68,014 | NM | ||||||||||

Net income (loss) attributable to non-controlling interest | 124 | 90 | 37.8% | ||||||||||

Net income (loss) attributable to Core Laboratories N.V. | $ | (114,137) | $ | 67,924 | NM | ||||||||

Diluted EPS (loss per share) from continuing operations | $ | (2.57) | $ | 1.33 | NM | ||||||||

Diluted EPS (loss per share) attributable to Core Laboratories N.V. | $ | (2.57) | $ | 1.51 | NM | ||||||||

Weighted average diluted common shares outstanding | 44,459 | 44,848 | (0.9)% | ||||||||||

Effective tax rate | (4) | % | (62) | % | NM | ||||||||

SEGMENT INFORMATION: | |||||||||||||

Revenue: | |||||||||||||

Reservoir Description | $ | 191,144 | $ | 208,941 | (8.5)% | ||||||||

Production Enhancement | 76,992 | 129,291 | (40.5)% | ||||||||||

Total | $ | 268,136 | $ | 338,232 | (20.7)% | ||||||||

Operating income (loss): | |||||||||||||

Reservoir Description | $ | 24,596 | $ | 22,057 | 11.5% | ||||||||

Production Enhancement | (137,623) | 20,336 | NM | ||||||||||

Corporate and Other | 1,487 | 2,029 | NM | ||||||||||

Total | $ | (111,540) | $ | 44,422 | NM | ||||||||

"NM" means not meaningful | |||||||||||||

CORE LABORATORIES N.V. & SUBSIDIARIES | |||||||||||||||||||||

CONDENSED CONSOLIDATED BALANCE SHEET | |||||||||||||||||||||

(amounts in thousands) | |||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||

% Variance | |||||||||||||||||||||

ASSETS: | June 30, | March 31, | June 30, | vs. Q1-20 | vs. Q2-19 | ||||||||||||||||

Cash and cash equivalents | $ | 20,958 | $ | 13,890 | $ | 12,546 | 50.9% | 67.0% | |||||||||||||

Accounts receivable, net | 101,464 | 126,872 | 134,900 | (20.0)% | (24.8)% | ||||||||||||||||

Inventory | 41,528 | 52,263 | 49,311 | (20.5)% | (15.8)% | ||||||||||||||||

Other current assets | 27,443 | 26,682 | 28,476 | 2.9% | (3.6)% | ||||||||||||||||

Total Current Assets | 191,393 | 219,707 | 225,233 | (12.9)% | (15.0)% | ||||||||||||||||

Property, plant and equipment, net | 119,866 | 123,112 | 125,699 | (2.6)% | (4.6)% | ||||||||||||||||

Right-of-use assets | 70,147 | 74,943 | 76,290 | (6.4)% | (8.1)% | ||||||||||||||||

Intangibles, goodwill and other long-term assets, net | 233,035 | 228,847 | 354,296 | 1.8% | (34.2)% | ||||||||||||||||

Total assets | $ | 614,441 | $ | 646,609 | $ | 781,518 | (5.0)% | (21.4)% | |||||||||||||

LIABILITIES AND EQUITY: | |||||||||||||||||||||

Accounts payable | $ | 23,693 | $ | 37,054 | $ | 41,995 | (36.1)% | (43.6)% | |||||||||||||

Short-term operating lease obligations | 12,028 | 12,583 | 12,968 | (4.4)% | (7.2)% | ||||||||||||||||

Other current liabilities | 63,563 | 58,810 | 69,863 | 8.1% | (9.0)% | ||||||||||||||||

Total current liabilities | 99,284 | 108,447 | 124,826 | (8.4)% | (20.5)% | ||||||||||||||||

Long-term debt, net | 286,610 | 302,420 | 290,022 | (5.2)% | (1.2)% | ||||||||||||||||

Long-term operating lease obligations | 57,449 | 60,162 | 62,737 | (4.5)% | (8.4)% | ||||||||||||||||

Other long-term liabilities | 104,951 | 105,506 | 111,441 | (0.5)% | (5.8)% | ||||||||||||||||

Total equity | 66,147 | 70,074 | 192,492 | (5.6)% | (65.6)% | ||||||||||||||||

Total liabilities and equity | $ | 614,441 | $ | 646,609 | $ | 781,518 | (5.0)% | (21.4)% | |||||||||||||

"NM" means not meaningful | |||||||||||||||||||||

CORE LABORATORIES N.V. & SUBSIDIARIES | |||||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||||||

(amounts in thousands) | |||||||||||||

(Unaudited) | |||||||||||||

Three Months Ended | |||||||||||||

June 30, 2020 | March 31, 2020 | June 30, 2019 | |||||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||||

Income (loss) from continuing operations | $ | (5,675) | $ | (108,338) | $ | 19,486 | |||||||

Income (loss) from discontinued operations | — | — | 7,971 | ||||||||||

Net Income (loss) | $ | (5,675) | $ | (108,338) | $ | 27,457 | |||||||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||||

Stock-based compensation | 2,865 | 10,530 | 3,245 | ||||||||||

Depreciation and amortization | 5,425 | 5,441 | 5,786 | ||||||||||

Deferred income tax | (180) | (7,374) | (3,356) | ||||||||||

Inventory write-down and impairments | 9,932 | 122,204 | — | ||||||||||

Gain on sale of business | — | — | (1,154) | ||||||||||

Gain on sale of discontinued operations | — | — | (8,808) | ||||||||||

Accounts receivable | 24,288 | 4,784 | (2,385) | ||||||||||

Inventory | 987 | (2,285) | 1,492 | ||||||||||

Accounts payable | (12,343) | 132 | (399) | ||||||||||

Other adjustments to net income (loss) | 1,697 | (3,069) | (4,798) | ||||||||||

Net cash provided by operating activities | $ | 26,996 | $ | 22,025 | $ | 17,080 | |||||||

CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||||

Capital expenditures | $ | (3,066) | $ | (3,340) | $ | (7,047) | |||||||

Proceeds from sale of business | — | — | 2,980 | ||||||||||

Proceeds from sale of discontinued operations | — | — | 16,642 | ||||||||||

Other investing activities | (206) | (544) | (316) | ||||||||||

Net cash provided by (used in) investing activities | $ | (3,272) | $ | (3,884) | $ | 12,259 | |||||||

CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||||

Repayment of debt borrowings | $ | (26,000) | $ | (20,000) | $ | (36,000) | |||||||

Proceeds from debt borrowings | 10,000 | 17,000 | 31,000 | ||||||||||

Dividends paid | (445) | (11,111) | (24,395) | ||||||||||

Repurchase of treasury shares | (198) | (1,238) | (604) | ||||||||||

Other financing activities | (13) | 6 | — | ||||||||||

Net cash used in financing activities | $ | (16,656) | $ | (15,343) | $ | (29,999) | |||||||

NET CHANGE IN CASH AND CASH EQUIVALENTS | 7,068 | 2,798 | (660) | ||||||||||

CASH AND CASH EQUIVALENTS, beginning of period | 13,890 | 11,092 | 13,206 | ||||||||||

CASH AND CASH EQUIVALENTS, end of period | $ | 20,958 | $ | 13,890 | $ | 12,546 | |||||||

CORE LABORATORIES N.V. & SUBSIDIARIES | |||||||||

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||

(amounts in thousands) | |||||||||

(Unaudited) | |||||||||

Six Months Ended | |||||||||

June 30, 2020 | June 30, 2019 | ||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||

Income (loss) from continuing operations | $ | (114,013) | $ | 59,784 | |||||

Income (loss) from discontinued operations | — | 8,230 | |||||||

Net Income (loss) | $ | (114,013) | $ | 68,014 | |||||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||

Stock-based compensation | 13,395 | 14,341 | |||||||

Depreciation and amortization | 10,866 | 11,373 | |||||||

Deferred income tax | (7,554) | (35,116) | |||||||

Inventory write-down and impairments | 132,136 | — | |||||||

Gain on sale of business | — | (1,154) | |||||||

Gain on sale of discontinued operations | — | (8,808) | |||||||

Accounts receivable | 29,072 | (6,321) | |||||||

Inventory | (1,298) | (2,915) | |||||||

Accounts payable | (12,211) | 947 | |||||||

Other adjustments to net income | (1,372) | 1,875 | |||||||

Net cash provided by operating activities | $ | 49,021 | $ | 42,236 | |||||

CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||

Capital expenditures | $ | (6,406) | $ | (12,230) | |||||

Proceeds from sale of business | — | 2,980 | |||||||

Proceeds from sale of discontinued operations | — | 16,642 | |||||||

Other investing activities | (750) | (338) | |||||||

Net cash provided by (used in) investing activities | $ | (7,156) | $ | 7,054 | |||||

CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||

Repayment of debt borrowings | $ | (46,000) | $ | (68,000) | |||||

Proceeds from debt borrowings | 27,000 | 68,000 | |||||||

Dividends paid | (11,556) | (48,769) | |||||||

Repurchase of treasury shares | (1,436) | (1,091) | |||||||

Other financing activities | (7) | — | |||||||

Net cash used in financing activities | $ | (31,999) | $ | (49,860) | |||||

NET CHANGE IN CASH AND CASH EQUIVALENTS | 9,866 | (570) | |||||||

CASH AND CASH EQUIVALENTS, beginning of period | 11,092 | 13,116 | |||||||

CASH AND CASH EQUIVALENTS, end of period | $ | 20,958 | $ | 12,546 | |||||

Non-GAAP Information

Management believes that the exclusion of certain income and expenses enables it to evaluate more effectively the Company's operations period-over-period and to identify operating trends that could otherwise be masked by the excluded Items. For this reason, we use certain non-GAAP measures that exclude these Items; and we feel that this presentation provides a clearer comparison with the results reported in prior periods. The non-GAAP financial measures should be considered in addition to, and not as a substitute for, the financial results prepared in accordance with GAAP, as more fully discussed in the Company's financial statement and filings with the Securities and Exchange Commission.

Reconciliation of Operating Income, Income from Continuing Operations and Earnings Per Diluted Share from Continuing Operations | ||||||||||||

(amounts in thousands, except per share data) | ||||||||||||

(Unaudited) | ||||||||||||

Operating Income (loss) from Continuing Operations | ||||||||||||

Three Months Ended | ||||||||||||

June 30, 2020 | March 31, 2020 | June 30, 2019 | ||||||||||

GAAP reported | $ | (2,567) | $ | (108,973) | $ | 28,008 | ||||||

Inventory write-down and impairments 1 | 9,932 | 122,204 | — | |||||||||

Cost reduction and other charges | 3,415 | 1,155 | 2,977 | |||||||||

Stock compensation 2 | — | 6,750 | — | |||||||||

Gain on sale of business | — | — | (1,154) | |||||||||

Foreign exchange losses (gains) | (98) | (576) | (218) | |||||||||

Excluding specific items | $ | 10,682 | $ | 20,560 | $ | 29,613 | ||||||

Income (loss) from Continuing Operations | |||||||||||

Three Months Ended | |||||||||||

June 30, 2020 | March 31, 2020 | June 30, 2019 | |||||||||

GAAP reported | $ | (5,675) | $ | (108,338) | $ | 19,486 | |||||

Inventory write-down and impairments 1 | 9,495 | 113,181 | — | ||||||||

Cost reduction and other charges | 3,265 | 924 | 2,381 | ||||||||

Debt issuance cost write-off | 328 | — | — | ||||||||

Stock compensation 2 | — | 6,750 | — | ||||||||

Gain on sale of business | — | — | (1,154) | ||||||||

Impact of higher (lower) tax rate 3 | (1,208) | 1,663 | 181 | ||||||||

Foreign exchange losses (gains) | (79) | (461) | (174) | ||||||||

Excluding specific items | $ | 6,126 | $ | 13,719 | $ | 20,720 | |||||

Earnings (Loss) Per Diluted Share from Continuing Operations | |||||||||||

Three Months Ended | |||||||||||

June 30, 2020 | March 31, 2020 | June 30, 2019 | |||||||||

GAAP reported | $ | (0.13) | $ | (2.44) | $ | 0.43 | |||||

Inventory write-down and impairments 1 | 0.21 | 2.53 | — | ||||||||

Cost reduction and other charges | 0.07 | 0.02 | 0.06 | ||||||||

Debt issuance cost write-off | 0.01 | — | — | ||||||||

Stock compensation 2 | — | 0.15 | — | ||||||||

Gain on sale of business | — | — | (0.03) | ||||||||

Impact of higher (lower) tax rate 3 | (0.02) | 0.04 | — | ||||||||

Impact on assuming dilution | — | 0.02 | — | ||||||||

Foreign exchange losses | — | (0.01) | — | ||||||||

Excluding specific items | $ | 0.14 | $ | 0.31 | $ | 0.46 | |||||

(1) | Three months ended June 30, 2020 includes inventory write-down charge of $9.9 million; Three months ended March 31, 2020 includes goodwill impairment charge of $114 million. | ||||||||||

(2) | Stock compensation expense recognized pursuant to FASB ASC 718 "Stock Compensation" associated with executives reaching eligible retirement age, which is nondeductible in the U.S. | ||||||||||

(3) | Includes adjustments to reflect tax expense at a normalized rate of 20%. Three months ended June 30, 2020 includes inventory write-down charge; Three months ended March 31, 2020 includes impairment charge and stock compensation expense which are partially deductible and nondeductible. | ||||||||||

Segment Information | |||||||||||

(amounts in thousands) | |||||||||||

(Unaudited) | |||||||||||

Operating Income (Loss) from Continuing Operations | |||||||||||

Three Months Ended June 30, 2020 | |||||||||||

Reservoir | Production | Corporate and | |||||||||

GAAP reported | $ | 13,534 | $ | (16,324) | $ | 223 | |||||

Foreign exchange losses | (98) | 135 | (135) | ||||||||

Cost reduction and other charges | 1,448 | 1,967 | — | ||||||||

Inventory write-down and impairments | 265 | 9,667 | — | ||||||||

Excluding specific items | $ | 15,149 | $ | (4,555) | $ | 88 | |||||

Return on Invested Capital

Return on Invested Capital ("ROIC") is based on Bloomberg's calculation on the trailing four quarters from the most recently reported quarter and the balance sheet of the most recent reported quarter, and is presented based on our belief that this non-GAAP measure is useful information to investors and management when comparing our profitability and the efficiency with which we have employed capital over time relative to other companies. ROIC is not a measure of financial performance under GAAP and should not be considered as an alternative to net income.

ROIC is defined by Bloomberg as Net Operating Profit (Loss) ("NOP") less Cash Operating Tax ("COT") divided by Total Invested Capital ("TIC"), where NOP is defined as GAAP net income before minority interest plus the sum of income tax expense, interest expense, and pension expense less pension service cost and COT is defined as income tax expense plus the sum of the change in net deferred taxes, and the tax effect on interest expense and TIC is defined as GAAP stockholder's equity plus the sum of net long-term debt, allowance for doubtful accounts, net balance of deferred taxes, income tax payable, and other charges.

Reconciliation of ROIC | ||||||||||||

(amounts in millions, except for ROIC and WACC data) | ||||||||||||

(Unaudited) | ||||||||||||

Bloomberg | Effect of non-cash charges | Excluding non-cash charges | ||||||||||

Net operating profit | $ | (28.9) | $ | 122.2 | $ | 93.3 | ||||||

Cash operating taxes | 50.1 | (1.4) | 48.7 | |||||||||

Total invested capital | 418.7 | 104.1 | 522.8 | |||||||||

Return on invested capital | (18.9) | % | NM | 8.5 | % | |||||||

Weighted average cost of capital | 6.1 | % | ||||||||||

Free Cash Flow

Core uses the non-GAAP measure of free cash flow to evaluate its cash flows and results of operations. Free cash flow is an important measurement because it represents the cash from operations, in excess of capital expenditures, available to operate the business and fund non-discretionary obligations. Free cash flow is not a measure of operating performance under GAAP, and should not be considered in isolation nor construed as an alternative consideration to operating income, net income, earnings per share, or cash flows from operating, investing, or financing activities, each as determined in accordance with GAAP. Free cash flow should not be considered a measure of liquidity. Moreover, since free cash flow is not a measure determined in accordance with GAAP and thus is susceptible to varying interpretations and calculations, free cash flow as presented may not be comparable to similarly titled measures presented by other companies.

Computation of Free Cash Flow | |||||||||

(amounts in thousands) | |||||||||

(Unaudited) | |||||||||

Three Months Ended | Six Months Ended | ||||||||

June 30, 2020 | June 30, 2020 | ||||||||

Net cash provided by operating activities | $ | 26,996 | $ | 49,021 | |||||

Capital expenditures | (3,066) | (6,406) | |||||||

Free cash flow | $ | 23,930 | $ | 42,615 | |||||

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/core-lab-reports-second-quarter-2020-results-from-continuing-operations-301098355.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/core-lab-reports-second-quarter-2020-results-from-continuing-operations-301098355.html

SOURCE Core Laboratories N.V.

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!