|

15.06.2017 22:30:00

|

Owens Realty Mortgage, Inc. Acknowledges Receipt of Letter from Freestone Capital and Issues Response

WALNUT CREEK, Calif., June 15, 2017 /PRNewswire/ -- Owens Realty Mortgage, Inc. (NYSE MKT: ORM) (the "Company") today announced that it has issued a letter in response to Freestone Capital Management's June 1, 2017 open letter to the Company's Chairman and Board of Directors. The full text of the letter follows.

June 15, 2017

Freestone Capital Management, LLC

701 Fifth Avenue, Suite 7400

Seattle, Washington 98104

Dear Mr. Furukawa,

On behalf of the Board of Directors of Owens Realty Mortgage, Inc. (the "Company"), I am writing in response to your letter of June 1, 2017. We value the constructive conversations we have held with you over the years and appreciate your continued feedback, perspective and interest in the Company. Considering our longstanding history of respectful engagement with you, we were surprised to see your concerns aired in a public letter without first giving us an opportunity to discuss these matters with you privately. We remain open to continuing an ongoing engagement with you, just like with any of our other stockholders. However, in light of the numerous misleading and inaccurate statements and statistics in your public letter, we feel compelled to set the record straight.

First and foremost, we remain steadfastly committed to acting in the best interests of the Company and all of its stockholders. As we announced earlier this week, we have authorized a new $10 million stock repurchase plan and have increased our quarterly dividend. These actions were set in motion and referenced in our public filings and earnings calls long before your June 1 letter. They were also heavily informed by extensive and ongoing stockholder discussions over a period of many months, and in-depth evaluations of the Company's balance sheet and capital needs. They demonstrate our continued commitment to thoughtfully and appropriately deploying capital to deliver immediate value to our stockholders. The announced repurchase plan on June 13th is the fourth authorized by the Board in as many years, and a clear illustration of the Board's belief in efficiently deploying capital. Over the past four years the Company has repurchased $12.9 million of its stock and paid out $15.1 million in cash dividends. Going forward, we will continue to opportunistically utilize these tools to close the valuation gap between our share price and book value.

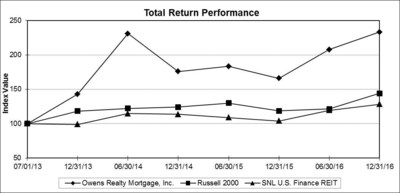

Contrary to your statement that the Company has a "history of trailing market returns", relative to the two indices you selected, we have generated significantly greater returns. During the period from our initial public listing, through April 30, 2017, the Company has generated a total stockholder return of 107.15%, significantly more than the returns generated by the FTSE AREIT Mortgage REIT Index and Russell 2000 Index of 46.90% and 46.01%, respectively. During the period since our public listing on July 1, 2013, we have created net earnings of over $70 million, or approximately $6.73 per share. As disclosed in our most recent Annual Report on Form 10-K, we have also substantially outperformed the SNL U.S. Finance REIT Index during the period from our initial public listing through the end of 20161:

The underlying cause of this discrepancy between your view and the reality of our financial performance results from your selective inclusion of data over a period that extends back over four years before Owens Realty Mortgage was even a publicly listed company. The metric you cite, total return to stockholders, includes public stock price appreciation as an input variable, and as this variable would not apply to the Company's pre-public predecessor (thereby artificially depressing the output), your attempted inclusion of pre-public, non-traded limited partnership performance data results in a highly misleading depiction of the value the Company has actually generated for its public stockholders.

With respect to the Management Agreement, as we announced earlier this week, our Compensation Committee has been engaged in a months-long internal analysis related to our external management structure, including possible amendments to the Company's management agreement that would replace the current management fee payable to the Manager with a management fee based on a stockholders' equity calculation that is similar to industry standards, or an internalization transaction. In an effort to conduct a thorough review, the Compensation Committee hired a leading independent consultant, FTI Consulting, as an external compensation advisor at the outset of this process. Ultimately, the conclusion the Compensation Committee reaches will be the product of a vigorous and analytical evaluation designed to maximize value for our stockholders.

Although we appreciate your ideas about how to increase stockholder value, we have serious concerns regarding the consequences of liquidation, including adverse economic consequences, negative tax implications, and the potentially significant downward pricing pressure that arises in many liquidations. The Board has been proactive - and will remain focused – on closing the gap between the Company's stock price and book value. The Company's stock repurchase program and increased quarterly dividend announced earlier this week are the most recent proofs of this commitment. We also continue to believe the Company's current strategy of disposing real estate assets in a responsible manner and reallocating the balance sheet from primarily real estate to commercial loan investments are the best methods of maximizing net returns and eliminating the valuation gap.

We would like to reiterate that the Board values and will continue to welcome and take into account the views and opinions of all of our stockholders. Once again, we thank you for your feedback and perspective.

Regards,

William C. Owens

Chairman of the Board

1This graph is a comparison of the cumulative total stockholder return on shares of the Company's Common Stock, the Russell 2000 Index, and the SNL U.S. Finance REIT Index, a published industry index, from July 1, 2013 (the day we commenced trading on the NYSE MKT) to December 31, 2016. The graph assumes that $100 was invested on July 1, 2013 in our Common Stock, the Russell 2000 Index and the SNL U.S. Finance REIT and that all dividends were reinvested without the payment of any commissions. There can be no assurance that the performance of the Company's shares will continue in line with the same or similar trends depicted in the graph below. The information included in the graph and table below was obtained from SNL Financial LC, Charlottesville, VA ©2017.

About Owens Realty Mortgage, Inc.

Owens Realty Mortgage, Inc., a Maryland corporation, is a specialty finance mortgage company organized to qualify as a real estate investment trust ("REIT") that focuses on the origination, investment, and management of commercial real estate mortgage loans. We provide customized, short-term acquisition and transition capital to small balance and middle-market investors that require speed and flexibility. Our primary objective is to provide investors with attractive current income and long-term shareholder value. Owens Realty Mortgage, Inc., is headquartered in Walnut Creek, California, and is externally managed and advised by Owens Financial Group, Inc.

Additional information can be found on the Company's website at www.owensmortgage.com.

Forward Looking Statements

This press release may contain "forward-looking statements" within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements about the Company's plans, strategies, prospects, and anticipated events, including the transactions or other items discussed in this Current Report, are based on current information, estimates, and projections; they are subject to risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "target," "assume," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," "may," "will," "could," "should," "believe," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements.

Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in the Company's most recent filings with the Securities and Exchange Commission including those appearing under the heading "Item 1A. Risk Factors" in the Company's most recent Annual Report on Form 10-K and each subsequent Quarterly Report on Form 10-Q. All subsequent written and oral forward-looking statements concerning the Company or matters attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.

Important Additional Information

The Company, its directors and certain of its executive officers are participants in the solicitation of proxies from the Company's stockholders in connection with matters to be considered at the Company's 2017 Annual Meeting of Stockholders (the "2017 Annual Meeting"). The Company has filed a definitive proxy statement and white proxy card with the U.S. Securities and Exchange Commission (the "SEC") in connection with its solicitation of proxies from the Company's stockholders. STOCKHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Information regarding the identities of the Company's directors and executive officers, and their direct or indirect interests, by security holdings or otherwise, are set forth in the proxy statement and other materials filed with the SEC in connection with the 2017 Annual Meeting. Stockholders can obtain the proxy statement, any amendments or supplements to the proxy statement, and any other documents filed by the Company with the SEC at no charge at the SEC's website at www.sec.gov. These documents are also available at no charge in the "SEC Filings & Reports" section of the Company's website at www.owensmortgage.com.

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/owens-realty-mortgage-inc-acknowledges-receipt-of-letter-from-freestone-capital-and-issues-response-300475012.html

SOURCE Owens Realty Mortgage, Inc.

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Owens Realty Mortgage Incmehr Nachrichten

| Keine Nachrichten verfügbar. |