|

31.08.2016 10:21:00

|

SoLocal Group Rejects the Accusations Raised by the RegroupementPPLOCAL Association in Its Letter to the AMF

Regulatory News:

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20160831005480/en/

The following is a statement of SoLocal Group: SoLocal Group (Paris:LOCAL) took note of the letter sent by the RegroupementPPLOCAL association to the Autorité des Marchés Financiers ("AMF”) on 22 August 2016 requesting the opening of an investigation related to the financial communication of the Group and to the evolution of SoLocal share price.

SoLocal rejects all accusations raised therein, which are unfounded and based on partial and false presentation of the reality, as explained in this press release.

The company has just sent to each of the signatories of such letter a formal demand to stop immediately these actions.

It has also requested that the Autorité des Marchés Financiers takes all appropriate measures to remind this association of the rules which apply to any stakeholder in the share capital of a listed company when making a public communication which questions the value of the share price.

SoLocal Group reminds that for several weeks, the RegroupementPPLOCAL association has decided to undertake a systematic smear campaign against the public communication of the company, through press releases and various means of public expression. The letter addressed by four representatives of this association to the Autorité des Marchés Financiers requesting the opening of an investigation related to the financial communication of the Group and to the evolution of SoLocal share price is to be viewed in this context. This request is supported by a set of slanderous accusations and unfounded allegations.

As the company is entering into a particularly critical stage for the renegotiation of its debt, SoLocal Group can only question the motivations of such strategy, which serves neither the shareholders’ interests, nor the corporate benefit of the company. These actions strategically bolster the efforts of some activists who claim to be able to interfere in the ongoing negotiations, or even to take a direct role in the operational management of the company.

These actions aim at destabilizing the company, its shareholders and the market of the company’s shares and now well exceed the framework of a simple difference in analysis.

Given the financial expertise highlighted by the representatives of this association, they cannot ignore the reality of the fundamentals of the company and its industry, nor the reasons for the evolution of the SoLocal share price over the last two years.

It is indeed particularly shocking and misleading for the market to read that the continuous decrease in the SoLocal share price as from July 2015 would be the result of a deliberate strategy of the company’s management in order to weaken the company's value and facilitate the entry of new investors.

The reality of the company, which its 5,000 employees must confront on a daily basis, consists in a massive and disproportionate indebtedness, which does not result from the recent decisions of its management or the company’s operational performances, but from a historical decision of its shareholders made in 2006 in the context of a leveraged buy-out disposal.

In a highly competitive industry, which requires constant investment and adaptation capabilities, SoLocal Group distinguishes itself with a continuing residual debt of €1.1 billion, which severely constrains its choices and operational and strategic investments. Such debt, which derives from the 2006 LBO operation, only benefited the company's shareholders, who have received an aggregate amount of €4 billion of dividends over the last 10 years.

This level of debt, and the operational constraints resulting therefrom via the bank covenants to which the company is subject, maintain the group in a situation of permanent underinvestment. However, this situation is not sustainable in light of the accelerating decline in the printed directories business of the group and the fast evolution of its new digital activities in a highly competitive global market. One only needs to look at the severe difficulties which all companies engaged in the printed directories business encounter to transform and survive, whether in the USA, the United Kingdom, Scandinavia, Italy, Belgium or elsewhere, and to note that historic shareholders have disappeared in all companies engaged in the group’s historical core business.

Implemented since 2013, the Digital 2015 program (communicated in detail to the financial market) allowed SoLocal to successfully complete its digital transformation. The group has become a world leader in local digital communication, is a major player in the French digital industry, and today is experiencing an increasing growth rate of its Internet business.

Unlike most of its foreign counterparts, SoLocal has been able to implement as from 2013 a massive transformation plan in order to develop new digital services, to answer the competitive intensity of the industry and its innovation needs. This plan has enabled the company to take a particularly decisive advance in the market of digital communication towards local businesses. The market has been consistently informed of the progress of this plan, through the publication of financial results and investors days.

This transformation has enabled the company to completely reorganize its business approach with the creation of business units specialized in the service of local digital communication for more than 500,000 French SMEs; to become the 6th group in France attracting the most Internet users on its websites; to attract new talents from the digital economy; to become the leader of markets such as business websites creation or local big data, to establish partnerships on an unprecedented scale with major Internet players such as Google, Apple or Microsoft.

It is regarded in many aspects as exemplary in comparison to the changes experienced by counterpart companies globally. However, the results of this transformation did not occur as quickly as expected, which was reported to the market. Still, they are now undeniable, as indicated in the last financial communication of the company, which evidences the company’s good commercial results since the beginning of 2016.

The closure of the bond market in July 2015, coupled with operational difficulties, has limited the group’s options and demonstrated that a debt reduction of a much larger scale was necessary.

SoLocal Group was very surprised to read in the RegroupementPPLOCAL association’s letter that the company's financial communication could be part of a "conscious, indeed complicit” effort to induce a massive and sustained debt reduction and to facilitate the entry of one or more privileged investors. It is very inaccurate to conclude that the substantial and steady decline in the SoLocal share price since July 2015 could have resulted from the financial communication of the company being inappropriate and from the company not commenting on the analysis note published at that time by Kepler Cheuvreux.

This profound misunderstanding of the recent events which have impacted the SoLocal share price is fundamentally at odds with the comments that we have heard from other shareholders.

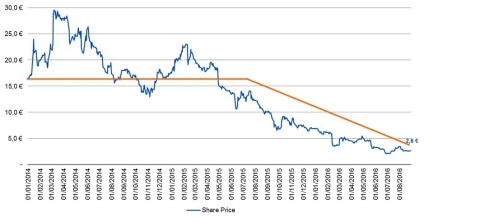

First, it is necessary to take into consideration the closure of the bond market in the summer of 2015 which introduced a major change in the trade-offs made by institutional investors. The evolution of the SoLocal share price and the theoretical yield of the PagesJaunes Finance SCA bond, attached hereto, show on the one hand that the continued decrease in the SoLocal share price started in July 2015, and on the other hand that the yields soared as from July 2015, rendering impossible the refinancing by the group of its debt in the bond market. In particular, this situation prevented the extension of the maturities of the group’s debt from 2018 to 2020, as initially planned in 2014. It should be recalled that, as part of the 2014 restructuring, a clause was negotiated to allow the extension of the maturity of the bank debt should the group succeed in refinancing its bond debt.

The second point lies in slower growth of the group’s sales in 2015. Facing a declining advertising market, the group has experienced an unexpected acceleration in the decline of its printed directories business, as well as operational difficulties in deploying its new organization that hindered the growth of Internet activities (such elements were widely announced by SoLocal to the financial market throughout 2015).

This evolution of the debt markets, the slower growth of the advertising market and operational difficulties are all hazards which have limited SoLocal’s options and which made the refinancing of its debt much more difficult.

In light of this deterioration in the outlook, the company has taken steps that have been widely announced to the market. First, in April 2015, the company engaged a cost reduction plan and the divestment of its unprofitable activities, which was fully implemented before the end of the year. Then, as from September 2015, a new plan has been developed in order to allow the company to cope with the new conditions of the bond market, to restructure its debt and to finance its "Conquer 2018” plan, aimed at solidifying the growth of the group’s Internet business and enabling it to achieve a growth rate of about 10%.

Since the end of 2014, the company has consistently pursued solutions for the refinancing of its debt. In April 2015, new operational performance indicators were reported to enable investors to better monitor the development of the company’s new activities. In the spring of 2015, the company prepared a bond issuance which would have allowed the extension of the debt’s maturities, but such attempt was abandoned in July 2015 because of the closure of the bond market. As from November 2015, the company has informed the market that it was exploring all possible options to refinance its debt, without excluding any. The Company has favored schemes limiting the dilution of its shareholders and has conducted discussions with nearly 40 investors worldwide, including certain existing shareholders, to find solutions.

In light of the strong evolutions experienced since 2014, priority has been given to the reduction of the level of debt to less than 5 years of net cash flow before debt service, in order to allow the company to pursue its development while being able to face multiple uncertainties.

With regards to the transformation of the group in the recent years, and the related risks, its communication has been transparent, factual and careful. Contrary to the criticisms expressed, the group has always aimed to communicate to the market the most truthful vision of the company’s transformation and its outlooks.

In its letter addressed to the Autorité des Marchés Financiers, the RegroupementPPLOCAL association retains from the massive transformation of the group only the cancellation of the 2013 employment safeguard plan by the French State Council (Conseil d’Etat) and the €35 million provision resulting therefrom.

It is undeniable that the cancellation of the homologation of the 2013 employment safeguard plan heavily burdened the company’s results for FY 2015. Nevertheless, SoLocal Group has never hidden from the market that such decision, obviously against its will, was likely to impact its results, and that it would not be able to assess the potential costs associated therewith before having ascertained the effective departure of the relevant employees and having acknowledged the claims initiated by those employees before the relevant jurisdictions – two elements that were not known until the end of 2015. To protect the interests of the company, and thus of its shareholders, in the context of litigations, the details of the calculation of the provisions, which are assessed individual by individual, based on the claims initiated, and which are subject to the review by the statutory auditors, have not been made public.

It is equally astonishing to see that this grouping of shareholders denounced a communication strategy purported to be deliberately alarming on the ground that the company based its 2016 guidance on the assumption of its refinancing options, as if the weight of the debt and of the bank covenants were only circumstances accessory to company’s investment and development capacities as of 2016. It was however plain that the time period required for the financial restructuring would condition the company’s growth objectives for 2016. The company disclosed it to the market as soon as it became clear that the said restructuring would not take place before the fall of 2016. A few weeks later, the company estimated and announced that it would breach a covenant at the end of June 2016. This pre-emptive communication demonstrates a rigorous approach and the criticism raised by the RegroupementPPLOCAL association in this respect is difficult to take seriously.

With a similar casualness, the RegroupementPPLOCAL association believes that the level of the debt can be viewed separately from the company’s operational capacities, and that it can put aside the urgent need to deal with the maturity of a debt "due in more than two years”. It is however useless to recall that the value of the company does not only result from the assessments of the market, but also from its technological, marketing and commercial performances which are only based on the Company’s ability to invest, to innovate and to recruit and keep the best talents in the digital labor market. Any additional delay would considerably weaken SoLocal in a fast-moving market.

Finally, questioning the appropriateness of the provision for depreciation of the PagesJaunes securities, which amounts to €1,640 million, is equally groundless. Presented in the company’s annual report, such provision has not been the subject of detailed comments since it has no impact on the consolidated accounts; its amount has been reviewed by the statutory auditors and established on the basis of a rigorous analysis of the company’s outlook at the balance sheet date which, as the company explained in its financial communication, deteriorated in 2015 due to the accelerating decline in the printed directories business of the group, on the one hand, and the delayed recovery for the Internet growth, on the other hand. Such provision was logically recorded in the accounts for FY 2015, which is the year when such difficulties appeared.

Therefore, all the questions raised by the RegroupementPPLOCAL association cannot be regarded as arguments which may be likely to put in doubt the transparency of SoLocal’s financial communication. The company has always insisted on the reality of the operational constraints experienced by the company and of the debt which is the underlying cause thereof. The arguments put forward by the RegroupementPPLOCAL association must not mislead the shareholders as to the necessity, the emergency and the relevance of the contemplated financial restructuring announced on 1 August 2016.

The new "Conquer 2018” plan is a unique opportunity to drastically reduce the group’s debt in a fair balance between the economic interests of the creditors, those of the shareholders and the corporate interest of the company.

After long and difficult negotiations, SoLocal Group has defined a plan aimed at a sustainable development and growth of the company, which is an essential condition to allow a rebound in its valuation. Such plan today appears to be sufficiently credible so that creditors who together hold more than 50% of the group’s debt support the contemplated reduction of their claims by two-thirds. It has also been approved by four of the five main shareholders of the company, who together represent 15% of its share capital. Some of these shareholders sought to be involved in the negotiations and consented to sign a non-disclosure agreement. This opportunity was also offered to the representatives of the RegroupementPPLOCAL association, which today deplores that it has not been able to participate in the discussions even though it refused to sign an agreement of this type.

Far from having tried to prejudice the interests of the shareholders, the company on the contrary wishes to offer them the possibility to subscribe to such share capital increase, the investment in capital by the creditors being increased only in the event that the shareholders would decide not to exercise part of their preferential subscription rights. The RegroupementPPLOCAL association today challenges such modalities and suggests that individual shareholders would refuse to participate in the restructuring, while demanding that the SoLocal share be immediately valued at its potential post-restructuring price. It should be recalled that it is based on this same logic that the company has been burdened with several billion euros of debt, following the 2006 LBO, a scenario which has deeply undermined the development of the company!

The management is strongly engaged in the share capital of the company and its remuneration is in line with the interest of the shareholders.

The RegroupementPPLOCAL association has expressed accusations on an alleged collusion between the management of the company and certain investors, in order to weaken the SoLocal share price. SoLocal Group strongly rejects such allegations and, should it still be necessary, reminds readers of the engagement of the managers to the share capital of the company. The Chairman of the Board of Directors has widely invested in the company in 2014 and then in 2015, and contrary to the statements made by the RegroupementPPLOCAL association, he is not the only member of the Board of Directors in this situation. Indeed, since he arrived in the group seven years ago, the Managing Director has invested in cash in the group more than 40% of his after-tax remuneration. Furthermore, the main managers of the company have been granted free shares in 2014 and have subscribed to the share capital increases of 2015. Therefore, the management of the company is directly concerned by the decrease in the share price and may in no event be suspected of pursuing an interest which would be different from individual shareholders.

The RegroupementPPLOCAL association also questions the level of the variable part of remuneration of the management. The objectives of the management as set by the Board of Directors for the year 2015 focused on the growth of Internet activities, their profitability and the resolution in a particularly short timeframe of continuing operational difficulties that implied a risk on the commercial results of the company. The achievement rate of such objectives takes into consideration such realizations and has been measured at 120%. Nonetheless, the management decided to waive its right to 25% of the variable part of remuneration which had been allocated to it, as it considered that the decrease in the SoLocal share price prevented it from considering such goals as 100% achieved. It should also be recalled that the alignment of the management’s remuneration with the share price is based on a long-term share incentive and performance conditions, as approved by the general meeting of shareholders in 2014.

Consequently, SoLocal rejects the accusations relating to its financial communication and wishes to reset the conditions for objective information of investors.

The slanderous and unacceptable nature of the accusations expressed by the RegroupementPPLOCAL association must cause each investor to question the real objectives pursued by this association.

The company cannot accept to be under the pressure of a grouping of shareholders that weakens its image by slanderous accusations at a critical stage of the renegotiation of its debt and that seeks to alter the communication of the management in a way that is more favorable to the interests of some of its members, regardless of the obligations of honesty, loyalty and transparency that the company must comply with.

About SoLocal Group

SoLocal Group, European leader in local online communication, reveals local know-how, and boosts local revenues of businesses. The Internet activities of the Group are structured around two business lines: Local Search and Digital Marketing. With Local Search, the Group offers digital services and solutions to clients which enable them to enhance their visibility and develop their local contacts. Thanks to its expertise, SoLocal Group earned the trust of some 530,000 clients of those services and over 2.2 billions of visits via its 4 flagship brands (PagesJaunes, Mappy, Ooreka and A Vendre A Louer) but also through its partnerships. With Digital Marketing, SoLocal Group creates and provides Internet users with the best local and customised content about professionals. With over 4,400 employees, including a salesforce of 1,900 local communication advisors specialised in five verticals (Home, Services, Retail, Health & Public, BtoB) and Internationally (France, Spain, Austria, United Kingdom), the Group generated in 2015 revenues of 873 millions euros, of which 73% on Internet and ranks amongst the first European players in terms of Internet advertising revenues. SoLocal Group is listed on Euronext Paris (LOCAL). More information may be obtained at www.solocalgroup.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20160831005480/en/

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Solocal Group Provient regroupementmehr Nachrichten

| Keine Nachrichten verfügbar. |